Touchscreen desktop computers set to enter the Australian market

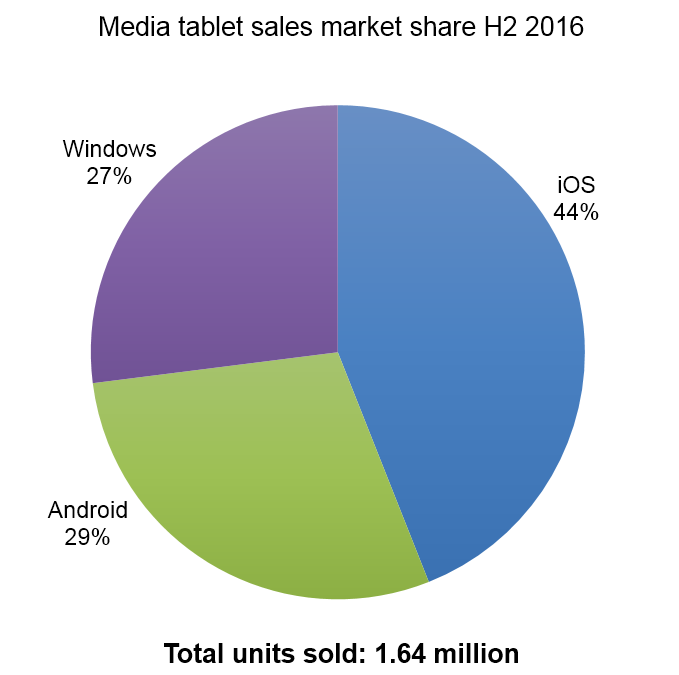

SYDNEY, AUSTRALIA – Sales of tablet devices continued to rebound in the second half of 2016 with 1.64 million units sold, according to the Telsyte Australian Tablet Market Study 2017.

The modest half-on-half increase of 2 per cent was facilitated by a boom in convertible ‘2-in-1’ Windows tablet sales which accounted for 27 per cent of all devices sold. Windows has almost overtaken Android (29%) but remains behind the market leader Apple with 44 per cent share.

Telsyte estimates that Australian sales of Windows tablets grew around 60 per cent half-on-half (2H 2016 vs 2H 2015) while during the same period Android tablet and iPad sales declined 13 per cent, and 9 per cent respectively. Convertible ‘2-in-1’s led the charge with the category now making up 30 per cent of sales, up from 15 per cent in 2H 2015 [1].

The latest findings show that Australians are moving significantly away from sub-premium (or low cost) tablets. Telsyte estimates less than 10 per cent of tablets sold in 2H 2016 fall into this category. According to Telsyte’s Australian Digital Consumer Study 2017, around 40 per cent of Australians are willing to pay more for ‘top quality electronics’ as digital devices become central to the consumer lifestyle.

Australian tablet users on average spend around 2 hours per day on their tablets, with primary usage still being at home (over 80%). The time spent on 2-in-1 tablets is more than 3 hours per day and over 30 per cent use them outside of home.

“Tablets are no longer just about media consumption, touchscreen devices are revolutionising the creative experience,” Telsyte Managing Director, Foad Fadaghi, says.

Tablets move beyond the handheld

Telsyte expects the introduction of larger format, desktop touch computers, such as Microsoft’s Surface Studio to boost an otherwise sluggish PC market which has struggled to give users a reason to upgrade. Telsyte estimates that the average replacement cycle for PCs in Australia has now grown to 4.7 years.

Telsyte believes Microsoft and its OEM partners will cater for different segments of this bourgeoning market developing both tabletop and desktop touch interfaces using Windows 10 in various form factors.

Telsyte estimates that by 2021, at least 10 per cent of desktop PCs sold will have touch screen interfaces, with more pervasiveness expected as screen price come down. Currently large format touch screens are more closely aligned to creative professionals, businesses and high end household budgets than the mainstream buyer.

Around 80 per cent of the ICT decision makers in Australia and New Zealand surveyed by Telsyte indicate that they are already buying or interested in purchasing larger format touch screen computers for their organisation.

Tablets accessories boom despite device sales remaining flat

Despite a slowdown in tablet unit sales from the boom years of 2012 to 2013, the market for tablet-related accessories continues to be a profitable category for leading retailers. Telsyte research shows that 71 per cent of tablet users have at some stage purchased some form of accessory for their device, with the top add-ons in 2016 being cases and keyboard-type covers. In addition, sales of pen input or stylus devices featured prominently for owners of 2-in-1 devices.

For further information on the study or media inquiries contact:

Foad Fadaghi

Managing Director

Tel: +61 2 9235 5851

Twitter: @foadfadaghi

Email: ffadaghi@telsyte.com.au

About Telsyte’s Australian Tablet Market Study 2017

Tablet definition: A computer device consisting of a 7 inch or larger touch screen that can be used in a slate format (not requiring keyboard or mouse). Telsyte’s definitions includes 2-in-1 devices with detachable or foldable keyboard, and tabletop, or reclinable desktop screens that provide a tablet form factor experience.

2-in-1 definition: Primarily refer to laptops that have a touch screen and detachable keyboards or foldable form factor to provide a pure tablet-like experience. Tablets that are known for their versatility and mimic laptop-like experience with keyboards or type covers are also considered as 2-in-1s. E.g. Microsoft Surface tablets, iPad Pro, Samsung Galaxy TabPro S, Google Pixel C, Sony Xperia Z4 Tablet, Toshiba Portege Z20t, or Lenovo Yoga 3 Pro.

In the 2017 study, Telsyte has provided forecasts for desktop touchscreen computers that can be used in a slate format. Please note this excludes blackboard style devices (e.g. Surface hub), or touchscreen laptops that require keyboard and mouse for operation (Telsyte considers these as laptop computers).

[1] Please note Telsyte measures Apple iPad Pro models as 2-in-1s for comparison reasons, due to having a specifically designed Apple keyboard, typically sold together.

Telsyte’s Australian Tablet Market Study 2017 is a comprehensive 113 page report which provides subscribers with:

- Market sizing, platform and vendor market shares and forecasts

- End user trends across devices, usage, platforms and accessories

- Tablet and computer purchase intentions and loyalty

- Product reviews and insights

- Tablet audience estimates and strategies for media companies

In preparing this study, Telsyte used:

- An online survey of a representative sample of Australians 16+ years of age conducted with 1,060 respondents in November 2016.

- An online survey of a representative sample of Australian & New Zealand CIOs and IT decision makers with 302 respondents completed in August 2016. Organisations had 20-20,000+ or more employees.

- Financial reports released by mobile carriers, manufacturers, retailers and service providers.

- Interviews conducted with executives from mobile operators, vendors, retailers, and channel partners.

- On-going monitoring of local and global market and vendor trends.

Editor’s note:

Telsyte measures sales of devices (“sell out”), not shipments or sales to retailers or carriers (sometimes called “sell-in”). Telsyte believes this is a more accurate measure of performance of products in a marketplace. Telsyte does not rely on disclosure from vendors or general assumptions made for large multinational companies that do not release local market data. Telsyte uses a comprehensive methodology that includes surveys of consumers, discussions with vendors, carriers and their partners, retailers, and financial analysts. In addition, public financial results from manufacturers and carriers are used. Telsyte tests a wide range of products in real life usage scenarios and conducts satisfaction and repeat purchase surveys with large and representative samples of Australian smart device users. Telsyte is a pioneer in measuring and reporting tablet sales in Australia and has been providing insights on tablet device since 2010.

Please note this study was formerly titled “Australian Media tablet market study”

The material in this article is copyright protected and not intended to be altered, copied, distributed or used for any commercial or non-commercial purpose, except for news reporting, comment, criticism, teaching and scholarship.