Australian Enterprise 5G market to generate $45 billion by the mid-2020s

The enterprise 5G market in Australia is forecast to generate around $45 billion per annum by the mid-2020s, consisting of next generation application development, IT services, platforms and connectivity, according new research from Australian emerging technology analyst firm, Telsyte

The Telsyte Australian Enterprise IoT & 5G Study 2019 shows more than two thirds (68%) of IT and business leaders already see 5G as crucial for their business strategy going forward. Half of these respondents indicating 5G was critical for future application development, as well as supporting existing applications.

Future applications are expected to make use of the huge data transfer capability, more reliable connectivity and lower latency, which will have the ability to change software architectures, allowing for real-time services and cloud based AI architectures.

The top three barriers to 5G investment cited were integration with current systems (34%), a lack of business case (23%) and security concerns (17%).

Lack of skills is also an issue with more than 25 per cent of respondents indicating they will be looking for an outsourced partner for developing 5G applications.

Enterprise IoT Maturity on the rise

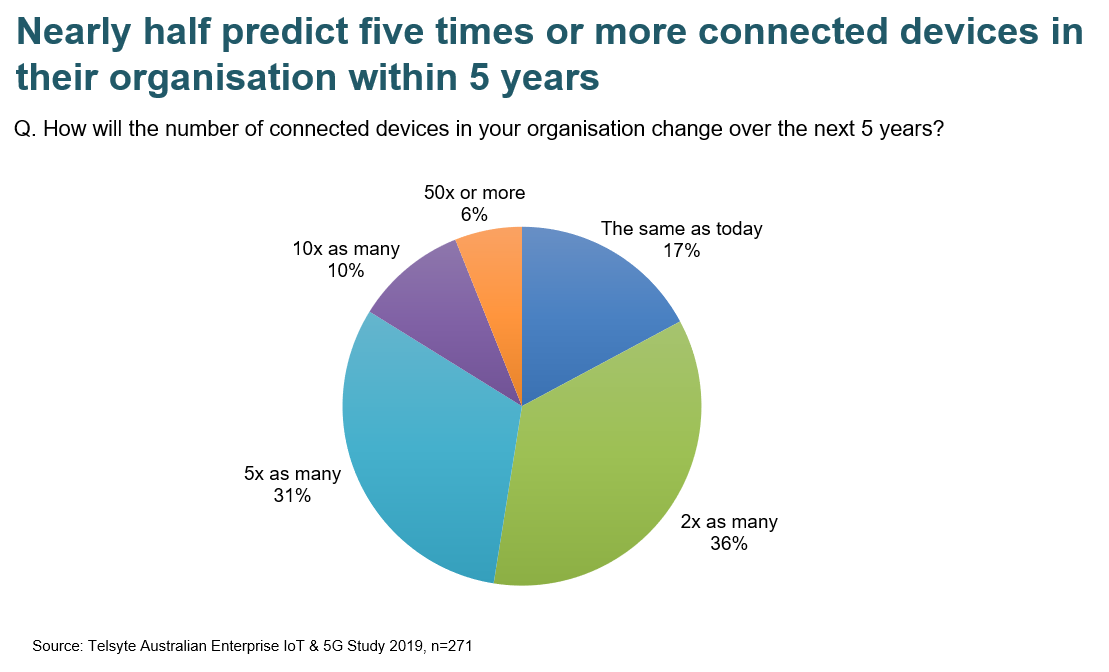

Nearly half of businesses surveyed expect five times or greater connected devices as today within their organisations within five years’ time. This explosion in devices is fuelling innovation and experimentation with “The Internet of Things” (IoT).

Telsyte’s latest Australian Enterprise IoT maturity model shows that 32 per cent of organisations now have a strategic approach to IoT, of which around half have pilot programs running or already have IoT in operations

Among companies that currently do not have a formal IoT strategy, almost 1 in 3 large organisations (200+ employee) plan to adopt an IoT strategy within 12 months.

The biggest barriers are lack of a business case (26%), IoT seen as too expensive (25%) and a lack of skills and expertise (20%). Among those that have overcome the barriers, early signs show that IoT is having a big impact on their businesses.

IoT applications promise big ROI

Enterprise IoT has a diverse range of applications, with the main areas businesses believe IoT will be used in being maintenance (32%), manufacturing (31%) and sales (30%).

Nearly a third (32%) of large firms are also reporting IoT to be suitable for customer service applications.

Of the third of existing businesses that have measured the Return on Investment (ROI) of IoT, 65 per cent claim it increased revenues; half saw an increase in productivity; and, similarly, half realised "better customer satisfaction or advocacy". This closely aligns to the early adopters of IoT which have been in the transport, logistics or asset heavy industries.

Operational cost savings was reported by 39 per cent of organisations, of which around 80 per cent saw nearly a one-third reduction in costs, either through efficiency gains or better management of assets.

Cohesive strategy imperative amid ‘shadow’ IoT

Like its close namesake “shadow IT”, or the spending on IT by non-IT groups in business, enterprises are now facing a wave of “shadow IoT”, where diverse teams are experimenting with connected devices, often unsanctioned or experimental in their nature.

Telsyte research found, one in four companies have IoT capable devices, but no formal strategy around them.

Telsyte research shows that while this approach is growing it does not come without challenges.

A high 81 per cent of companies with shadow IoT are experiencing "stalled" projects.

Other issues such as inconsistent technology selection, poor fit for purpose and higher costs are also experienced by organisations experiencing shadow IoT.

Telsyte Managing Director, Foad Fadaghi, says businesses that are just tinkering with IoT devices are hitting a wall.

"Critical to the success of implementing IoT strategies seems to be taking a scalable and holistic approach, with security considered upfront," Fadaghi says.

The study found more than half of the survey respondents believed that around a quarter of their IoT devices might be connected via cellular technology within 3 years’ time. Around a quarter of organisations believe up to 50 percent could be connected via mobile networks.

For further information on the study or media enquiries contact:

Foad Fadaghi

Managing Director

Tel: +61 2 9235 5851

Email: ffadaghi@telsyte.com.au

Alvin Lee

Senior Analyst

Tel: +61 2 9235 5890

Email: alee@telsyte.com.au

The Telsyte Australian Enterprise IoT & 5G Study 2019 is a comprehensive study which provides subscribers with:

Maturity levels, marketing sizing and insights into emerging trends in IoT and 5G

Enterprise IoT & 5G trends across enterprise applications, return on investment, cyber security, and 5G outsourcing

Australian organisations IT trends and strategies

Strategic analysis of market trends and challenges

In preparing this study, Telsyte used:

An online survey of 271 IT decision makers across Australian organisations with greater than 20 employees.

The respondent was required to have a strong understanding of their organisation’s IT purchasing and strategy, but was not limited to the CIO or IT department

Sampling was conducted on a size of spend weighting basis, with 60% of respondents coming from organisations with greater than 200 employees

Public information released by service providers, vendors and platforms.

On-going monitoring of local and global market and vendor trends

About Telsyte

Telsyte is Australia’s leading emerging technology analyst firm. Telsyte analysts deliver market research, insights and advisory into enterprise and consumer technologies. Telsyte is an independent business unit of DXC.technology. For more information visit www.telsyte.com.au

The material in this article is copyright protected and not intended to be altered, copied, distributed or used for any commercial or non-commercial purpose, except for news reporting, comment, criticism, teaching and scholarship.