SVOD subscription services continued to grow strongly in 2019 driven by Australians’ love for sports and video entertainment

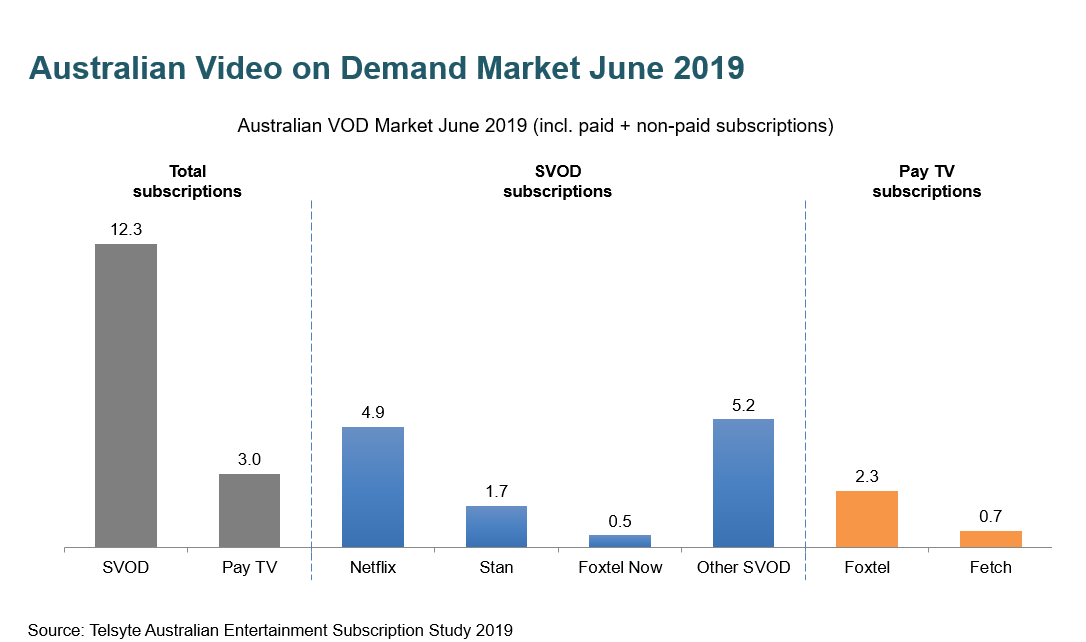

SYDNEY, AUSTRALIA, Australians have a growing taste for sports and video entertainment content sending the Subscription Video on Demand (SVOD) services market to new heights, reaching 12.3 million total subscriptions at the end of June 2019, according to new research from Australian emerging technology analyst firm, Telsyte.

A solid year-on-year increase of 29 per cent has driven subscription up from 9.5 million in June 2018. Today more than half (55%) of Australian households subscribe to SVOD services.

Households continue to show a demand for multiple services , with 43 per cent have more than one SVOD service, up from 30 per cent in 2018. This has steadily been increasing as consumers turn to multiple providers that are battling it out for content rights.

The Telsyte Australian Entertainment Subscription Study 2019 found Netflix is the market leader with around 4.9 million subscriptions and Stan passed the 1.7 million mark at the end of June 2019, remaining the second largest single service provider.

The sports SVOD category saw continued strong demand, driven by adoption of Kayo Sport, Optus Sport and AFL, FFA, Netball and NRL Live passes via Telstra. Telsyte estimates the total “sports” SVOD category (excluding Foxtel Now as it provides a mix of sports and other entertainment content) had around 4.4 million subscriptions at the end of June 2019, up from 3.6 million in June 18, driven by new services and telecom services bundles.

The report found the total Pay TV market maintained just over 3 million subscriptions at the end of June 2019, including cable, satellite and IPTV Fetch TV. Foxtel’s Pay TV segment has been under continued pressure due to increasing adoption of SVOD, including its own base shifting to Foxtel Now and Kayo Sport. Fetch TV remained the growth engine for the Pay TV market.

New content to maintain growth

Telsyte’s latest consumer survey shows those willing to pay for video subscription services have an average monthly budget of around $30 to cover all their video entertainment needs. The same survey also shows 1 in 3 Australians have no set limit to the number of paid video subscription services they would simultaneously subscribe.

“Subscriptions will be a critical way entertainment and technology brands connect with and monetise their customers,” Telsyte Managing Director, Foad Fadaghi, says.

SVOD services have been proven to be highly sticky in Australia and Telsyte’s latest consumer survey shows nearly half of existing SVOD users believe there will always be enough new content to keep them interested and will not cancel their service, regardless of how many hit TV shows the service has to offer.

Total SVOD subscriptions could reach more than 21 million by the end of June 2023 to meet Australians’ appetite for content. Telsyte believes the demand of existing and new SVOD services will be driven by key content rights during the next 12 to 24 months as more studios and content producers prepare to launch direct services.

Telsyte research shows 1 in 4 Australians (and 37% of existing SVOD users) are interested in subscribing to a potential new a powerful entrant in Disney.

Telsyte research shows there is an opportunity to cross bundle different type of subscription services such as SVOD and streaming music services. Only 1 in 3 Australians subscribe to both SVOD and music streaming services.

Among those do not subscribe to both services, around 1 in 6 would be interested in subscribing to bundled services if it will cost them less to subscribe to the services separately. This might be an opportunity for global players such as Google, Amazon and Apple.

Streaming music continues to grow

As with TV, the streaming music subscriptions market continued to grow steadily driven by service bundles, regular promotions and rapid adoption of smart speakers. Telsyte estimates Australians have taken up more than 12 million streaming music subscriptions at the end of June 2019, with 42 per cent being paid subscriptions.

The top 3 streaming music service providers in Australia remained Spotify, Google (including Google Play Music, YouTube Music and YouTube Premium) and Apple.

Usage of streaming music has just taken over radio time with the average subscriber listening 7.5 hours a week, compared to 7.3 hours for radio. Telsyte forecasts there will be 16.2 million streaming music subscriptions by the end of June 2023.

The availability of very large mobile data caps has been influencing consumer behaviour around radio consumption, facilitating more streaming in car.

Gaming a key subscription market

Telsyte anticipates the gaming market to become the other major entertainment subscription segment alongside streaming video and music subscription services as consumers are becoming more comfortable with the subscription model.

Telsyte research shows Australians have already taken up more than 4 million games related subscriptions at the end of June 2019, consisting of computer and console games subscriptions (such as EA Access and Xbox Game Pass), massively multiplayer online game (MMOG) subscriptions (such as World of Warcraft) and console subscriptions (e.g. PlayStation Plus, Xbox Live Gold).

Telsyte estimates the number of games subscriptions could close to quadruple to more than 16 million by the end of June 2023 with better access to fast Internet connectivity, the arrival of next generation game consoles and new services such as Apple Arcade and Google Stadia that appeal to a broader audience with the ability to play on different devices.

Telsyte research shows around 12.7 million Australians play digital games across devices and more than 8 million play on smartphones alone.

The same research shows 42 per cent of Australians that play games are interested in game subscription services and 1 in 4 are interested in cloud gaming services.

“Game subscriptions have been more focused on consoles and computers, but there are untapped opportunities on mobile with a large base of casual and regular players,” Telsyte Senior Analyst, Alvin Lee, says.

Telsyte expects there will be more than 15 million 5G handsets in use by the end of June 2023, forming the foundation for cloud gaming services adoption.

For further information on the study or media enquiries contact:

Foad Fadaghi

Managing Director

Tel: +61 2 9235 5851

Email: ffadaghi@telsyte.com.au

Alvin Lee

Senior Analyst

Tel: +61 2 9235 5890

Email: alee@telsyte.com.au

The Telsyte Australian Entertainment Subscription Study 2019 is a comprehensive study which provides subscribers with::

Market sizing and forecasts of the Australian entertainment subscriptions market, including video, music and games.

Key market share data in SVOD, BVOD, Pay TV, Music and games

Insights into consumer attitudes and technology adoption trends

Uptake, intention and detailed analysis of

Video services including: SVOD, pay TV and BVOD services

Streaming music services

Games subscription services

Services consumption preference including devices, fixed and mobile service.

Insights into the future of entertainment subscription services in Australia.

In preparing this study, Telsyte used:

An online survey conducted in July 2019 with a representative sample of 1,026 respondents, 16 years and older.

An online survey conducted in November and December 2018 with a representative sample of 1,025 respondents, 16 years and older.

Interviews conducted with executives from media companies, service providers, network operators, content providers, retailers, and hardware manufacturers.

Financial reports released by media companies, service providers and network operators.

On-going monitoring of local and global market and vendor trends.

About Telsyte

Telsyte is Australia’s leading emerging technology analyst firm. Telsyte analysts deliver market research, insights and advisory into enterprise and consumer technologies. Telsyte is an independent business unit of DXC.technology. For more information visit www.telsyte.com.au

The material in this article is copyright protected and not intended to be altered, copied, distributed or used for any commercial or non-commercial purpose, except for news reporting, comment, criticism, teaching and scholarship.